Pre-Tax vs. Roth

Take Advantage of Tax Benefits

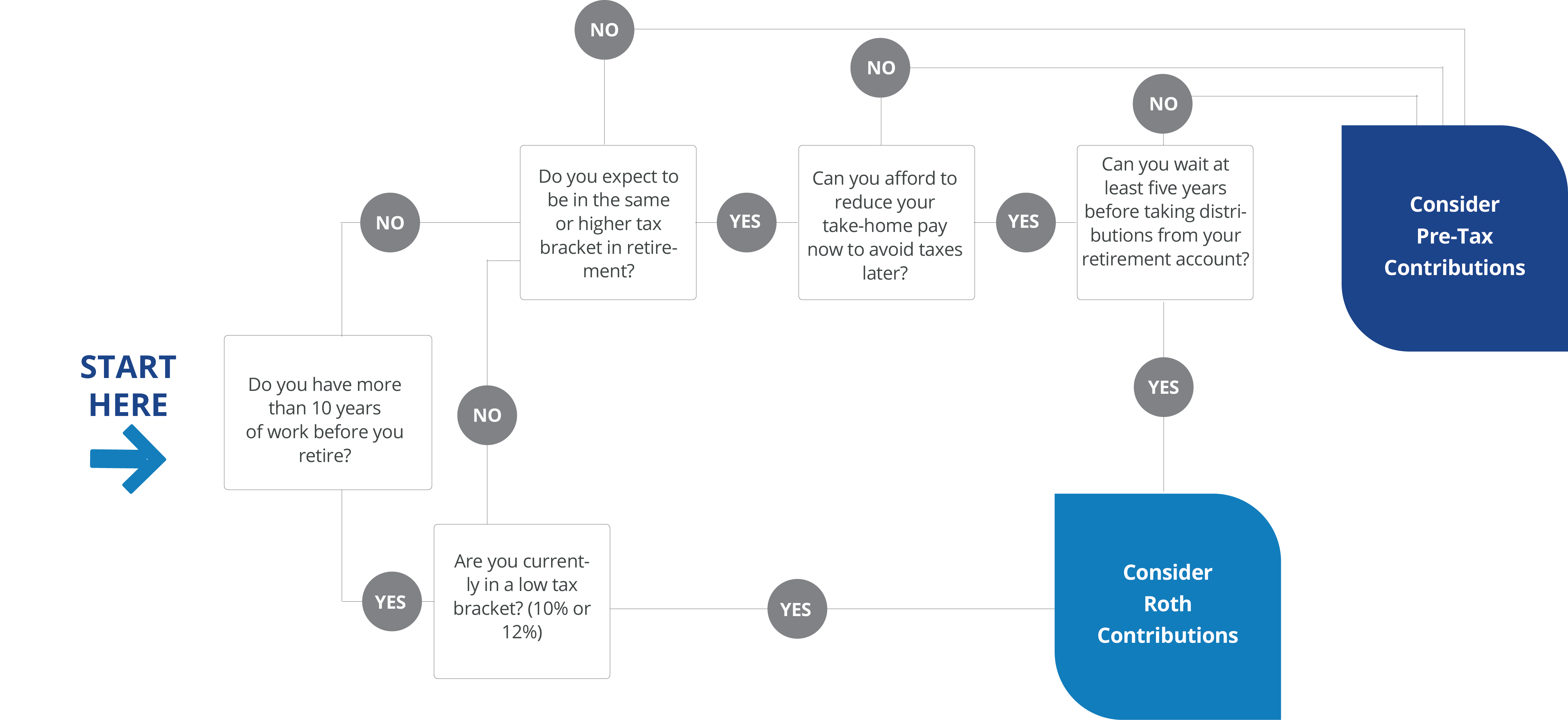

Salary deferral contributions to your plan can be made on either on a pre-tax (Traditional) or after-tax (Roth) basis, or a combination of both. Which contribution option is best for you? The short answer is – it depends.

Determining which option (or combination of both) is currently best for you will vary based on your specific circumstances. The following questions can help guide your decision.

Please note, this tool is provided for informational purposes and is not intended to be tax, legal or accounting advice. Before deciding on a type of contribution, talk with a tax professional who can take into account any special factors that apply to you.

In addition, you may want to consider a Roth Contribution if:

1. You are a younger employee in a low tax bracket and have more time to accumulate tax-free earnings.

2. Your Gross Annual Salary exceeds the IRS maximum limit to invest in a Roth IRA but want tax-free money to draw on

in retirement.

3. You want to leave tax-free money to your heirs.

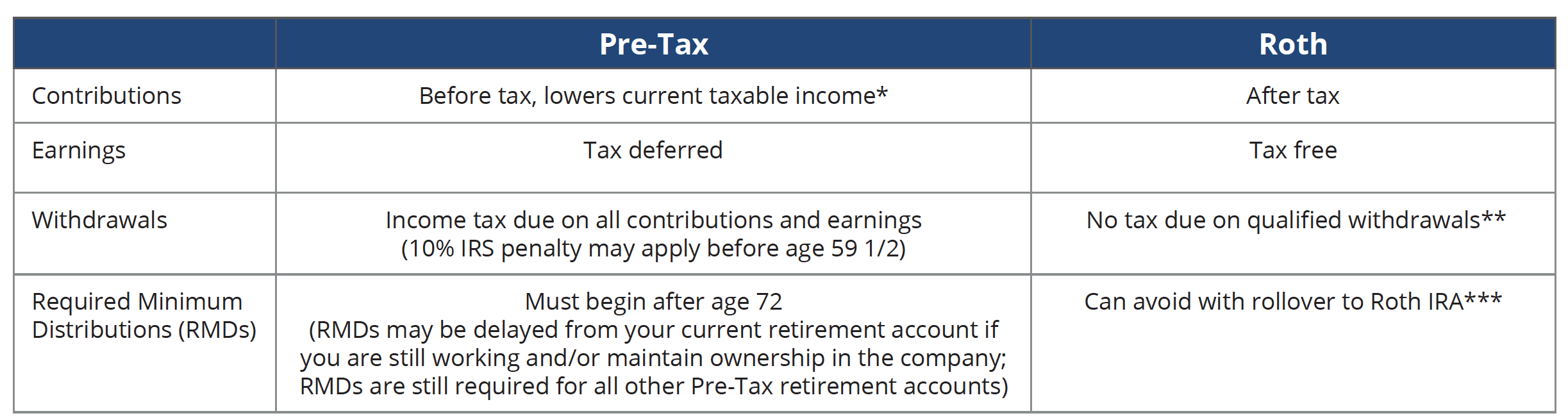

*Federal and most states

**You must hold account at least five years and past age 59½. Other withdrawals may be subject to a 10% IRS penalty if you are under age 59½.

***Review the fees and expenses you pay, including any charges associated with transferring your account, to see if rolling over into an IRA or consolidating your accounts could help reduce your costs. Employer-sponsored retirement plans may have features that you may find beneficial such as access to institutional funds, fiduciary selected investments, and other ERISA protections not afforded other investors. In deciding whether to do a transfer from a retirement plan, be sure to consider whether the asset transfer changes any features or benefits that may be important to you..

- A Financial Wellness Tool

- A Financial Wellness Tool